IGR Karnataka:- For human survival and housing, land is an essential resource. Revenue administration deals with the concerns of all social segments and interested parties. In addition to resolving people’s land-related problems, the Revenue and Disaster Management Department’s (R&DM) activities include providing land to the homeless and protecting government property. In practically every state in India, there is an Inspector General of Registration (IGR), and Karnataka is no exception. The agency in charge of determining and collecting stamp duty and registration fees on real estate transactions is IGR Karnataka. On the portal, users can take advantage of several services, including those for calculating registration costs, registering properties, and learning IGR Karnataka market value. Continue reading this article to learn more about these services in detail.

About IGR Karnataka 2024

Inspector-General of Registration (IGR) for Karnataka. Karnataka is the administrative unit in charge of collecting taxes on a range of movable property deals as well as other associated services. IGR was a project launched to increase state-level property registration. Almost every state has established a portal, which is run by the state government. Not only is the procedure expedited, but it also increases state revenue. IGR Karnataka contributes to the state’s revenue generation, which supports the economy as a whole. You can take advantage of services like property registration, stamp duty payment, document searches, and determining the market worth of the property through an internet site.

Additionally, the web offers tools for searching for registered copies and necessary indexes. The department’s karunadu.karnataka.gov.in website is another resource that citizens can use to learn more about tasks linked to property registration.

Also Read: Karnataka Seva Sindhu

Key Highlights of IGR Karnataka

| Launched By | Government of Karnataka |

| Name of Portal | IGR Karnataka Online Stamps and Registration For 2023 |

| Objective | To provide online property-related details |

| State | Karnataka |

| Full Form of IGR | Inspector-General of Registration |

| Beneficiaries | Residents of Karnataka |

Benefits and Features of IGR Karnataka

The following are some of the main advantages and characteristics of IGR Karnataka:

- The IGR Karnataka portal’s services are available at any time. You can always submit an application for aid from the comfort of your home.

- For a small number of services, the IGR Karnataka portal offers electronic signatures.

- Users can access user manuals or tutorials on the website. It makes it easier for users to comprehend the services effectively.

- The registration process for the website is quick. Your name, address, PAN number, contact details, and Aadhar number are all that are required to register on the platform.

- On the IGR Karnataka or Kaveri Online Services Portal, a live dashboard is provided that displays the number of applications and their statuses.

- A user can instantly download any relevant documents or application forms. The property registration form, for example, is available through the portal.

IGR Stamp Duty and Registration Fees

Each time a property is registered with the government in Karnataka, stamp duty is due. Depending on the price of the property, stamp duty payments in Karnataka can range from 2% to 5%. In a similar line, Karnataka’s registration fees are equal to 1% of the property’s worth. The Karnataka government additionally charges an additional tax on top of stamp duty as well as registration and stamp fees. A 10% cess and an additional 2% in stamp duty are charged. The surcharge and cess, for instance, will be Rs 36,000 if the stamp duty fees are Rs 3 lakh.

Encumbrance Certificate Fee

| Particulars | Fees |

| General Search for the First year | Rs- 35\- |

| For every other year | Rs-10\- |

Certified Copies Costs

| Particulars | Fee |

| Copying fee for every 100 words | 5 Rupees |

| Single search fee | 25 Rupees |

| For Computer registered Docs for every page | 10 Rupees |

Documents Required

The following are some of the crucial documents needed for IGR Karnataka Registration:

- Address proof

- Property card

- Sale deed with the signature of all the parties

- DD should be ready, which shows payment of total stamp duty, registration charges, and other charges.

- Power of Attorney

- Adhaar card

- Identity proof of both the parties, seller, buyer, and witnesses

- PAN card

- Encumbrance Certificate

Steps for IGR Karnataka Portal Registration

The actions listed below must be followed by the user to register on the IGR Karnataka Portal:

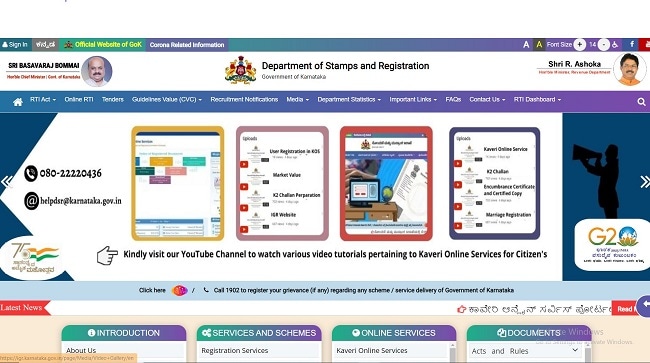

- Visit the IGR Karnataka official website first.

- The website’s home page will appear on the screen.

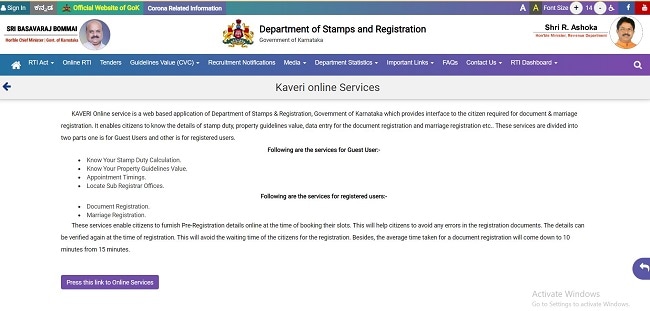

- Select Kaveri Online Services from the Online Services tab.

- The screen will display the login page.

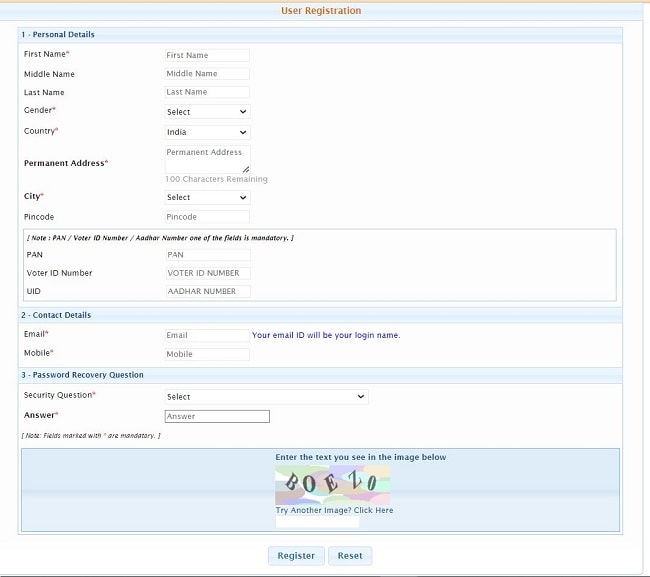

- Select the link to Register as a New User.

- On the screen, the registration form will appear.

- Now, complete the form by entering all the necessary information, such as your name, gender, address, city, pin code, Aadhaar number, email address, mobile number, and security question.

- To finish the registration procedure, enter the captcha code and click the Register button.

Steps for the IGR Karnataka Portal’s Pre-Registration Data Entry Process

The user must follow the instructions below to complete the IGR Karnataka Portal’s pre-registration data entry process:

- First, visit IGR Karnataka’s official website.

- The website’s home page will appear on the screen.

- Select Kaveri Online Services from the Online Services tab.

- The screen will display the login page.

- To log into your registered account, enter your login information and password now.

- Once you have successfully logged in, select the Document Registration and PRDE Process tabs.

- The screen will change to a new page.

- Now, complete the form with all necessary information, such as the document’s kind, execution date, number of pages, parties, etc.

- To continue, click the Save and Continue button.

- Enter the property and party information now, including the names, ages, genders, dates of birth, marital status, etc.

- Press the Save button.

- Click on Check Stamp Duty and Registration Charges after that.

- Now, pay the necessary charge at the SRO’s office or online.

- Enter the witness information after that.

- Continue and upload each of the necessary documents along with the payment receipt.

- After everything is finished, you can schedule an appointment for property registration.

How to Calculate Online Stamp Duty and Registration Fees

The user must adhere to the instructions below in order to calculate Registration Fees and Stamp Duty online.

- First, visit IGR Karnataka’s official website.

- The website’s home page will appear on the screen.

- Select Kaveri Online Services from the Online Services tab.

- The screen will display the login page.

- To log into your registered account, enter your login information and password now.

- Click on the Stamps Duty and Registration Fee Calculator once you have successfully logged in.

- The screen will change to a new page.

- Select the type of document you want, such as a sale deed, gift deed, affidavit, or cancellation deed.

- Select the Stamp next, and then select the Show Details button.

- The screen will change to a new page.

- To continue with the computation of stamp duty and registration fees, select a property region type now.

- Enter the property’s market value after that, if you want to calculate it.

- To determine the market value of the property, however, if you have not already done so, click on Calculate the Market Value.

- Click the Calculate button now after entering the property’s market value.

- The calculation will finally open on the screen.

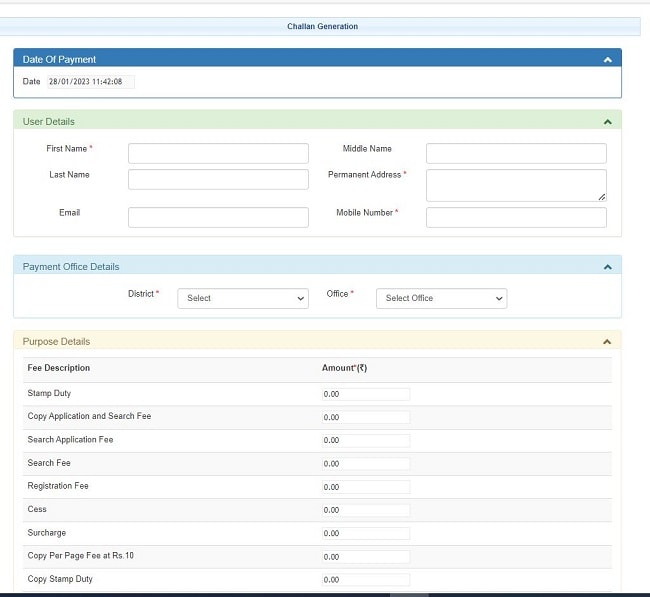

How to Create a Challan

The user must adhere to the instructions mentioned below in order to generate the challan.

- First, visit IGR Karnataka’s official website.

- The website’s home page will appear on the screen.

- Select “Generate Challan” from the menu.

- Now, input all the needed information, such as your name, phone number, email address, etc.

- the next. the payment office information and the purpose information

- At last, type the captcha code and press the “Submit” button.

How to Get an Encumbrance Certificate with a Signature

The user must carry out the procedures listed below in order to obtain a signed copy of the encumbrance certificate:

- First, visit IGR Karnataka’s official website.

- The website’s home page will appear on the screen.

- Select Kaveri Online Services from the Online Services tab.

- The screen will display the login page.

- To log into your registered account, enter your login information and password now.

- After successfully logging in, select the Encumbrance Certificate menu item.

- On the screen, the application form will appear.

- Fill out the form now with the necessary information, such as the property number, registration period, region, village, district, hobli, border information, etc.

- Click the Send OTP button after that.

- You’ll receive an OTP at your registered mobile number.

- A PDF file of your property will open on the screen after you enter the received OTP.

- Check the information once again, then press the Submit button.

- Make the desired payment next, and then print the receipt for your records.

- The processing of an encumbrance certificate request could take up to 10 days. In a few days, you will have a copy of the encumbrance certificate.

Contact Details

- Sub-Registrar Corporate Office,

- Ambedkar Veedhi, Sampangi Rama Nagar,

- Bengaluru, Karnataka 560009

- Deputy Secretary to Govt. (Land Grants & Land Reforms)

- Room No. 526, 5th Floor, Gate-3, M S Building,

FAQs of IGR Karnataka

Stamp duty is a type of tax that is imposed on documents.

The Central Government can only levy stamp duty on the following instruments: Bills of exchange Cheques Promissory Notes Bills of lading Letters of Credit Policies of Insurance Transfer of Shares Debenture receipts.

Before accepting a deposit, a flat developer must register an agreement. Such an advance or deposit shall not exceed 20% of the agreed-upon condition.